Summary

The ITC is expected to be stepped down in December 2016.

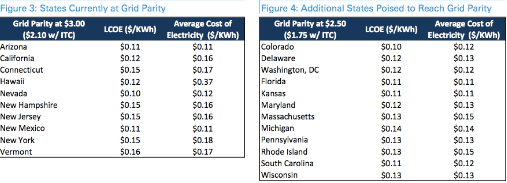

Solar industry is expected to grow with solar reaching grid parity in many US states.

Major residential players have successfully reduced their per watt cost and look confident to face the step down.

The Investment tax credit or ITC as it is commonly known, is regarded as the most generous federal incentives granted by the federal government for promotion of solar energy. It started in the year 2006 and is now due for step down in December 2016. According to this scheme, any residential or commercial establishment could claim a 30% tax credit from his tax bills for any rooftop installation which was installed before December 31, 2016. This tax credit will be reduced to nil or 10% depending upon the type of installation after December 2016, unless otherwise modified by the Congress. Though the federal tax credit played a very important role in boosting the solar installations in the USA, I believe the industry has now matured enough to carry on even if the ITC is not extended.

What is the Investment Tax Credit and its time span?

The investment tax credit enables the installer to claim a credit in the taxes he would pay. The ITC allows a 30% rebate for both commercial and residential installations placed in service before December 31, 2016. There is no doubt that the investment tax credit policy was started to boost the rooftop installations in USA. The 30% tax credit was first implemented for two years from 2006 till 2007, extended by a year’s time and thereafter had an eight-year extension. The ITC is set to drop from 30% to 10% for commercial systems and zero for residential systems by the end of 2016.

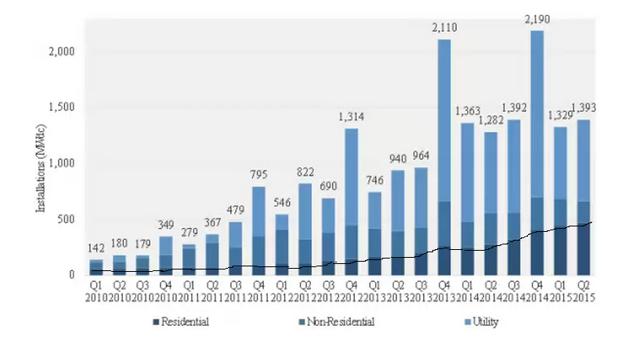

ITC enabled the rooftop solar to grow

USA has witnessed a boom in its rooftop installations and a major portion of the credit will go to the ITC implementation. Incentives play a major part in boosting a particular technology. The federal incentives and regulations have always helped an industry mature, especially during the initial stage when the prices are high and not affordable by the general masses. Residential solar installations in USA increased by 6% in Q2’15 and 11% in Q1’15 on a quarterly basis. According to an infographic, the number of houses with rooftop solar is expected to reach 3.8 million by 2020, from just 30,000 homes in 2006.

Source: GreenTechMedia

i) Impact on costs

Almost half of the US states have already reached grid parity or are very close to attaining it. This means it makes more sense for them financially, to invest in a solar system than to be grid connected. The LCOE or Levelized cost of energy for solar system is almost equal to the electricity prices. Moreover, the solar costs are expected to fall by another 40% in the next couple of years.

Source: Community energy Inc

ii) Impact on demand growth

In terms of quantifying the impact of no state incentives, nearly 25% of the total residential solar installations came online without any state incentive in Q1 2015. The residential markets of California and Arizona continue to grow, even without any residential incentives. States like New York and Nevada are also showing a small growth in installations without the support of state incentives.

Source: SEIA

On the other hand, another analyst from Bloomberg said “With a proposed five-year federal ITC extension, we anticipate an additional 22 GW of solar will get built by 2022.” Though the residential solar will grow, the pace of growth will be slower.

iii) Impact on big Residential Installation Companies – The three big residential installers in USA are SolarCity (NASDAQ:SCTY), Vivint Solar (NYSE:VSLR) and Sunrun (NASDAQ:RUN). They have been successful in reducing their costs to a level that should help them see a smooth transition into the year 2017 even if ITC is not extended.

SolarCity is the biggest installer in the USA. The company in its recent Q2’15 earnings report mentioned that it would be able to maintain healthy unlevered IRRs of approximately 7.5% and an equity NPV of roughly $0.60 per watt, with 10% ITC in 2017.

Vivint Solar was successful in reducing its cost per watt to $3 in Q2’15, down from $3.21 in the first quarter of 2015 and $3.55 in the second quarter of 2014. The company too should remain competitive going into 2017. Sunrun’s cost is a little over Vivint Solar at $3.07 per watt but in my view Sunrun will be cost competitive as well.

Possibility of an ITC extension remains, as the Obama government is in favor of extending the ITC. Hilary Clinton also remains extremely pro-solar energy with her 500 million solar panels target however some Republicans are opposing it.

Downside Risks

It is a fact that the solar installations will face a slowdown in the year 2017 if solar installations no longer enjoy the tax credit. BNEF expects a drop of around 8 GW in the solar project pipeline, if the ITC is not extended. Another area of concern might be the Solar+storage. It is expensive to install solar plus storage compared to the grid prices. The storage industry is still in a nascent stage and would require financial subsidies to become popular. The ITC step down in 2016 will increase the costs particularly for solar and storage. This might dissuade people to install the solar storage component as it will still be expensive.

Conclusion

I am not totally ruling out the extension of ITC since some USA markets still depend upon federal incentives to make residential solar a viable option, but I believe a substantial section of market has already matured and will grow even if the ITC is not granted an extension. The prices of solar energy has fallen dramatically (more than 75%) in the last decade, when ITC came into being. Though I would vote in favor of the ITC getting an extension, I also think all good things have to come to an end. With the industry entering a mature state and major residential installers looking confident, the dominance of solar energy is inevitable in the long run. I would not worry about ITC not getting extended though it would help in a faster acceleration in solar energy adoptions.

The End Of Investment Tax Credit For Solar Energy Will Not The Kill Solar Industry

No comments:

Post a Comment